Our Lowest Price Ever

Use Code FPANC2025

Expires Friday, May 30

Get started for free, and then pay month-to-month or save 20% with an annual subscription.

2 week free trial

Try Waterlily for free before you buy

Free

Run up to 10 LTC forecasts

Live customer support

Automated quote-and-compare

AI-assisted policy applications

Annual

Use Code FPANC2025

$46

/mo

$200

Price is per-seat per month

First 100 clients included

Live customer support

Automated quote-and-compare

AI-assisted policy applications

Monthly

Use Code FPANC2025

Go month-to-month with no long-term commitment

$59

/mo

$250

Price is per-seat per month

First 100 clients included

Live customer support

Automated quote-and-compare

AI-assisted policy applications

Get started for free

Cancel anytime

Money back guarantee

As covered by

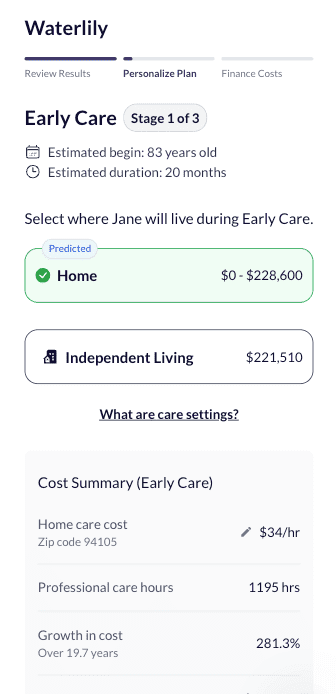

Waterlily's AI predicts your client's future long-term care and builds a plan that's fully personalized to them.

Build conviction. Analyze coverage. Do more.

3

Don't just take our word for it, take a look at some of the reviews below.

John Sieb

Long-Term Care Business Head

& COO

Prudential

The Waterlily care planning capability is a first of it’s kind digital solution that looks at care planning in a more holistic, innovative and informative manner that leverages data and AI with an eye towards including family, friends and trusted advisors in the decision making process. The tool was easy to navigate, presents different scenarios and quickly determines critical next steps. The output was simple to read and actionable. Overall, it was a fantastic and fulfilling experience that should be used in multiple life phases: pre-retirement, retirement and receiving care. A value-added capability that’s complimentary to a financial plan.

Traditional retirement planning software often includes basic LTC assumptions or broad Monte Carlo scenarios. These can overlook personal health factors, local care costs, and how family caregiving might evolve. Waterlily’s AI digs deeper—analyzing extensive datasets to accurately forecast the timing, progression, and real dollar impact of care. You get a richer conversation, clients get peace of mind, and your practice stands out for its thoroughness.